Now that South Carolina lawmakers have even more money to allocate than originally expected as they put together their budget for the upcoming fiscal year, House Republican leadership and the governor want to push a larger tax cut than originally planned.

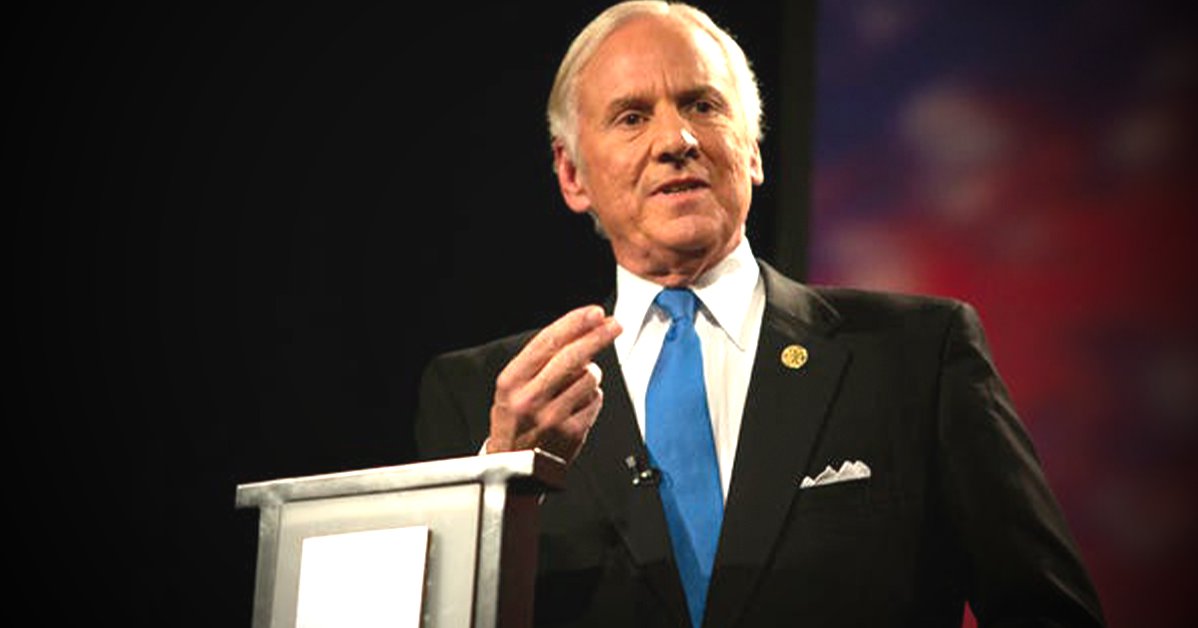

Gov. Henry McMaster, along with House Speaker Jay Lucas, R-Darlington, Ways and Means Chairman Murrell Smith, R-Sumter, and House Majority Leader Gary Simrill, R-York, are now calling for a tax cut that includes going to two main tax brackets, 3% and 6.5%, down from six tax brackets.

Over five subsequent years, the maximum rate would be reduced by a tenth of a percentage point a year until the maximum rate reaches 6%. The tax cut for each year would only take place if general fund revenue grows by at least 5%.

The current maximum income tax rate is 7%. It’s a plan that in five years could result in $1 billion being kept out of the state’s coffers annually, according to estimates from the Revenue and Fiscal Affairs Office.

“It is a basic Republicans principle that we keep taxes low, and I believe that when there’s a surplus of money flowing in our coffers that needs to be returned to the people,” Lucas said.

The proposal follows new estimates from the Board of Economic Advisors that say lawmakers have nearly $4.6 billion in additional money to allocate this year. The previous estimate was $3 billion in additional money.

McMaster’s latest push for the tax cut comes as he and the entire House are up for reelection.

“This is going to happen, and it will start an avalanche of change and prosperity unlike anything we’ve seen,” McMaster said in his office, surrounded by Republican House members. “The normal trend is there’s going to be an increase. We are confident we’re on the way up,” McMaster said.

“The federal money did help, but the conservative policies that we had in this state are what have allowed this this to occur.”

The South Carolina Chamber of Commerce on Tuesday lauded the tax cut proposal.

“Many states around the country have already seized the opportunity from robust revenues to reduce their tax burdens, so it is critically important that South Carolina take similar action this year to remain competitive,” Chamber of Commerce President and CEO Bob Morgan said in a statement.

Most recently, about 1.1 million tax returns paid the the 7% maximum tax rate, and more than 292,000 tax returns paid a tax rate between 4% and 6%.