The Washington Examiner reports:

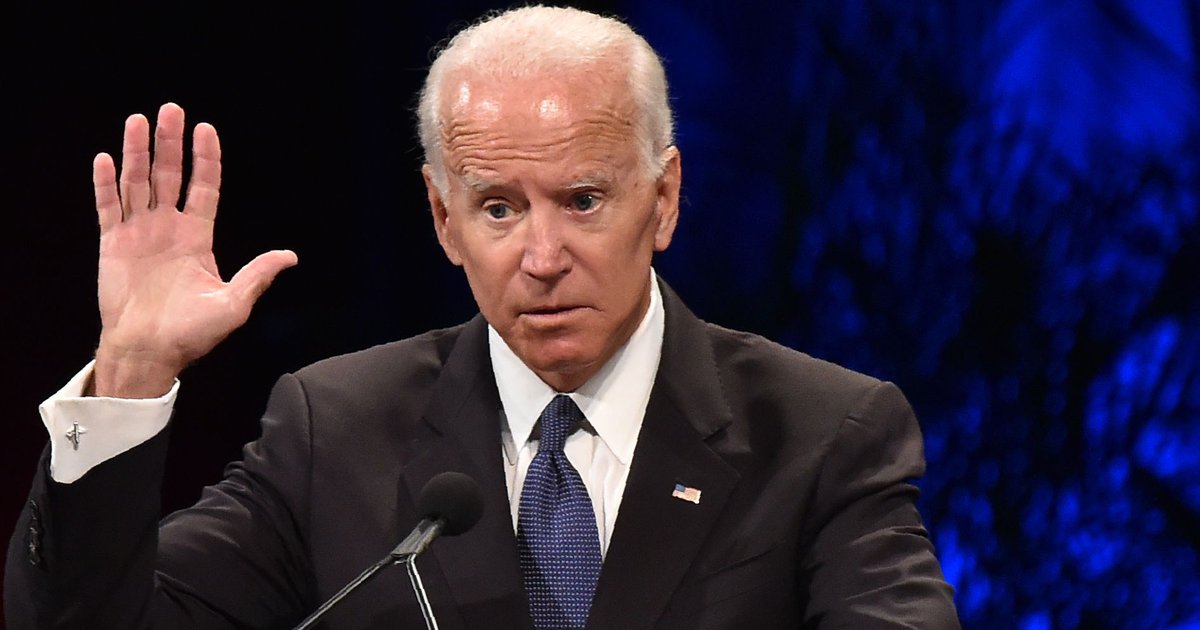

Joe Biden's tax plan would raise taxes by $4 trillion over the coming decade, mostly paid by wealthier taxpayers, the nonpartisan Tax Policy Center estimated Thursday.

The analysis shows that the former vice president's tax agenda is well to the left of past Democratic presidential campaigns. The same group, for instance, projected that Hillary Clinton’s 2016 tax proposal would have increased taxes by $1.4 trillion over a decade.

Under Biden's plan, "the highest-income households would see substantially larger tax increases than households in other income groups, both in dollar amounts and as a share of their incomes,” concludes Thursday's report. It finds that the top 1% of taxpayers would pay about three-quarters of the tax increase, in the first year it was phased in. Yet taxpayers at all income levels would see tax hikes, mostly because of Biden's plan to raise the corporate income tax rate, a change the group assumes would partly be shouldered by workers.

The former vice president’s plan would roll back the tax cuts that President Trump signed into law in December 2017 for individuals earning more than $400,000. It would also tax capital gains at the higher ordinary income tax rates for individuals earning at least $1 million. Under current law, capital gains are at 20% for high-income earners, while tax rates on ordinary income go as high as 37%.

Biden’s plan also seeks to eliminate a feature of the tax code that prevents heirs from being taxed on the increase in assets that occurred during the decedent's life. Democrats have described that wrinkle, known as the "step up in basis," as a loophole for wealthy families.

In addition, the plan would increase the top corporate income tax rate from 21% to 28%, reversing some but not all of the reduction in the 2017 GOP tax overhaul. Before that legislation, the rate had been 35%, the highest among developed nations.